Venture Philanthropy

Participation Form

Please relay any questions to brett@carolinaangel.net and submit your commitment with the form below. Your submission of this form is non-binding and we will follow up after the close with final paperwork and instructions.

FAQs

-

A DAF is a philanthropic giving vehicle that allows donors to contribute charitable assets, receive an immediate tax deduction, and recommend grants to nonprofits over time.

-

No. This is not an investment opportunity and does not offer financial return. It is a charitable initiative to support the growth and impact of mission-driven companies through philanthropic capital.

-

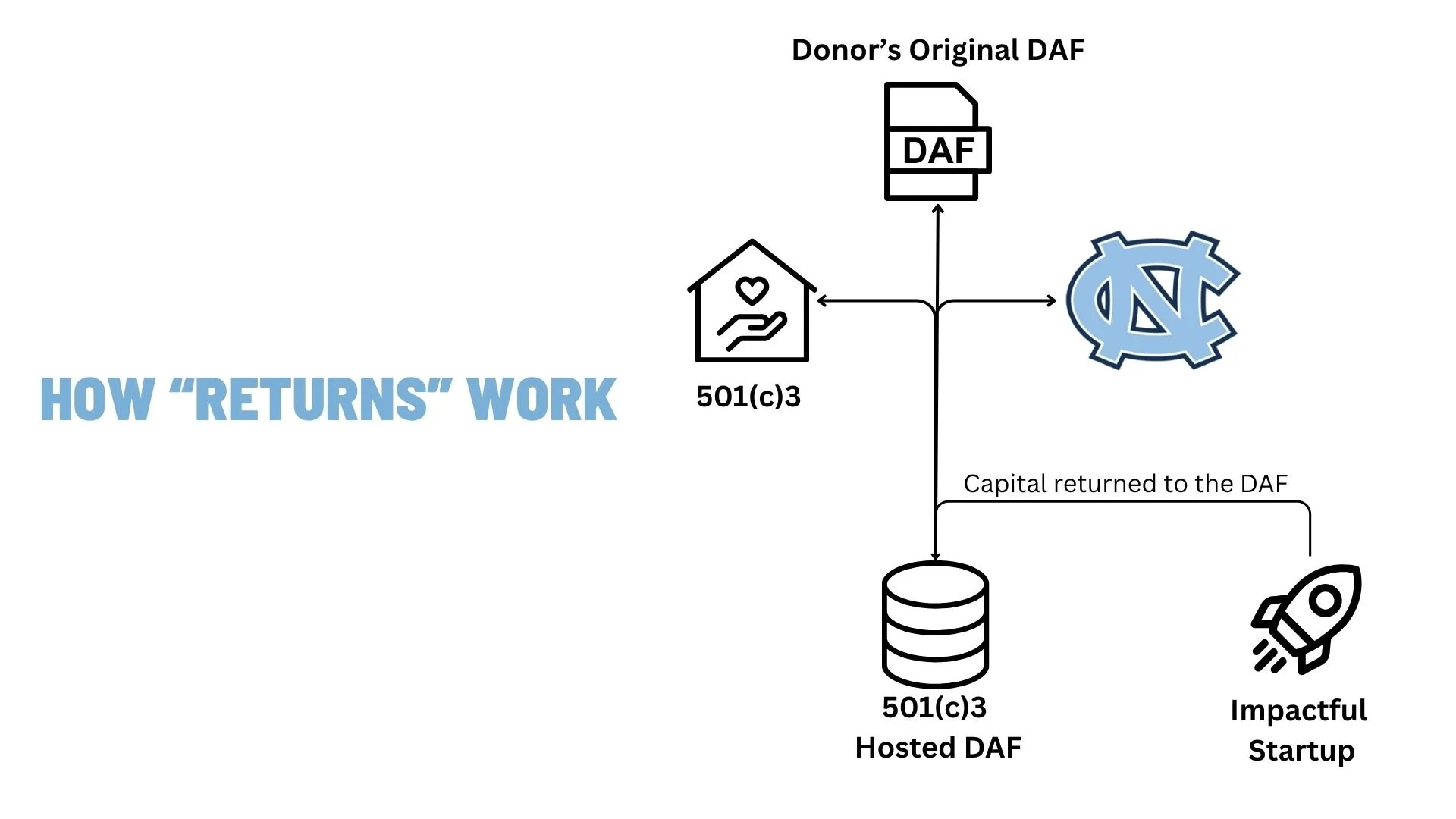

At the time of your contribution, you will pre-select how any potential regranted proceeds should be allocated. All funds must remain dedicated to charitable purposes and can be directed to qualified 501(c)(3) organizations. For individuals contributing through an existing DAF, any returned proceeds can be regranted back to the original DAF for future philanthropic use.

-

You will have the option to elect percentages across this list, adding up to 100%.

____% Carolina Angel Network Endowed Support Fund (Min of 2% for $25k+ and 5% for less than $25k commitments)

____% Carolina Angel Network Revolving Seed Fund (investments to build our early pipeline - evergreen fund)

____% Innovate Carolina - Translation Activities (assisting in the commercialization activities for University IP)

____% UNC Obstetrics and Gynecology

____% Original DAF named above (for initial contributions of $25k+)

____% External Non-profit named _____________________ (for contributions of $25k+ and subject to approval)

-

There is no minimum contribution required to participate. Contributions under $25,000 will be pooled into a single Donor-Advised Fund (DAF) advised by the Carolina Angel Network. Donors will pre-select how any redistributed grants are allocated to charitable initiatives affiliated with UNC-Chapel Hill.

For contributions over $25,000, donors will have the option to direct a portion of any regranted proceeds to their personal DAF for future charitable use.

-

We’ve partnered with Inspire Access, a nonprofit that enables catalytic, impact-driven support for companies like Couplet Care. After funding through a charitable donation, Inspire Access will invest all funds in Couplet Care.

-

There is no accreditation requirement and this opportunity is available for anyone interested in participating. Individuals can make a tax-deductible donation. DAF holders & Private Foundations can make a grant to participate.

-

3 year - 5% promissory note with interest payments accrued, but not paid until Year 2

-

CAN has always served—and will continue to serve—as an intermediary for private investments. Many individuals have philanthropic capital sitting in donor-advised funds (DAFs) or foundations and seek to use those resources to drive meaningful impact.

We’re now extending CAN’s role to offer a structured way to do just that. By making a DAF investment through CAN’s partner, you’ve added a new asset class to your philanthropic portfolio—one with the potential to grow and be re-granted for exponential, long-term impact.

Disclaimer: This is not a solicitation for investment. It is intended solely to share information about a charitable opportunity to support Couplet Care through a donor-advised fund in partnership with Inspire Access. Please consult your tax advisor or attorney to understand how this opportunity may apply to your specific financial and tax situation.